From the time a consumer realizes they need new insurance coverage to when they renew their policy, insurers have opportunity to engage and foster a positive customer experience. The goal is to drive better retention and growth by creating loyal policyholders who are satisfied with the relationship.

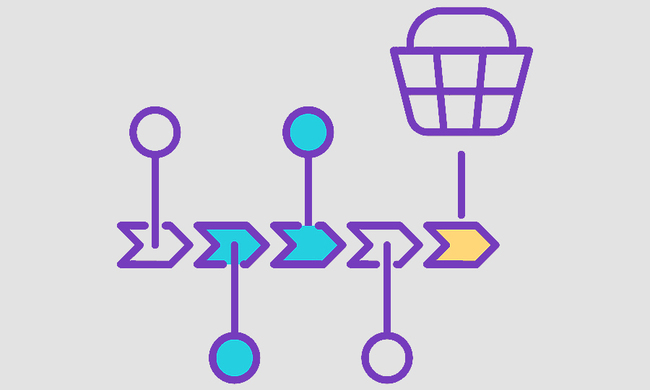

This process is referred to as the insurance customer journey, and it is constantly evolving to adapt to new consumer trends, emerging technologies, and industry regulations. The insurance customer journey remains a key concept insurers need to understand and optimize for strong business performance.

What Is the Insurance Customer Journey?

The insurance customer journey map, or policyholder journey, encompasses each stage of a consumer purchasing a policy and any renewals or cancellations that follow.

Insurers should be familiar with the individual stages of the customer journey because they provide insight into the possible pain points that may arise in the process. This, in turn, illuminates insurer opportunities to improve the overall customer experience from start to finish and, ultimately, stay competitive.

The Key Stages of the Insurance Customer Journey

A policyholder’s journey begins before they even reach out to a potential insurer to request an initial claim, and extends beyond the issuance of a new policy. Let’s walk through each individual stage of the policyholder journey.

Awareness of need

The first stage of the policyholder journey is awareness. The consumer recognises they need coverage, but may not yet have a specific insurer in mind. Many events can trigger this need, including the loss of existing coverage, the purchase of a new home or vehicle, or other personal affairs that necessitate new insurance coverage.

Information search and evaluation

The next stage in the journey is when consumers begin to research potential insurers. This might begin with a simple search online for providers, seeking recommendations from family and friends, or discovering a local office that offers the insurance products they’re looking for.

With a shortlist prepared, consumers may further evaluate each insurer to find the best fit for their needs. This might include requesting a quote or inquiring about specific insurance products and possible coverage to compare different providers. Depending on the insurer, consumers may need to reach out over the phone, visit an office, or submit a form online to receive this information.

Policy selection and purchase

After completing their evaluation, consumers will narrow down their options and select the individual insurer and policy they prefer. They will then purchase a specific policy at the premium quoted by the insurer, providing any supporting information or paperwork necessary to complete the application process.

Policy use and management

Next, the policyholder should confirm the terms and conditions of coverage, so the consumer understands what is and isn’t covered by their policy. This includes reviewing any limits, exclusions, or renewal provisions that apply.

Today, part of policy management may require the policyholder to log into the insurer’s online portal or mobile app. From there, they can manage key details about their policy, including payment information, accessing policy documents, updating beneficiaries, adding or removing coverage, and more.

Claims filing and resolution

At some point, an incident or loss may occur that requires policyholders to draw on their coverage and file a claim. After the initial purchase of their policy, this may be the first time they have to interact with their insurer.

Policyholders will report a covered incident to their insurer, who will likely request documentation and evidence to support the claim. The policyholder works with a claim adjuster to assess the extent of the damage and determine coverage eligibility. Based on their findings, they either approve or deny the claim and compensate the policyholder as outlined in their policy.

Policy renewal or cancellation

The policyholder journey ends with a policy renewal or cancellation. Before their policy expires, policyholders will likely receive renewal notices from the insurer. At this time, they can evaluate their coverage needs and determine if they would like to renew their policy, update their coverage, or cancel and seek new coverage from a different insurer.

The Benefits of Optimizing the Insurance Customer Journey

How insurers manage the customer journey can have a direct impact on the policyholder’s overall experience, satisfaction, and loyalty. Optimizing this journey allows insurers to stand out from competitors by offering a seamless and convenient experience that encourages policyholders to keep or renew their policies rather than seek new coverage elsewhere. At each stage of the journey, insurers can find ways to improve and enhance touchpoints, building more trust and stronger relationships with policyholders, therefore strengthening revenue retention.

Tips to Improve the Insurance Customer Journey

Insurers that create a seamless and engaging customer journey will be more competitive in the digital age, and better able to meet the evolving needs of consumers. Here are some of our expert suggestions and tips for improving the insurance customer experience.

Simplify the claims process

When a loss or accident causes a policyholder to draw on their coverage, time is of the essence. Any processing delays or complications can create policyholder frustration, increasing risk of turnover.

A simplified claims process, whether through an online portal, web form, or mobile app, can improve customer retention in the insurance industry. Transforming the claims process allows insurers to deliver a policyholder-centric experience by streamlining the claims approval process to minimize delays and reduce paperwork.

Offer personalized insurance options

Personalizing the policyholder experience can be a powerful tool to enhance the overall customer journey. Insurers can offer personalized products or coverage recommendations with the help of data analytics that are specific to the policyholder’s needs and risk profile.

In practice, this means that a single 27-year-old who drives one vehicle will get a different policy recommendation compared to a married 45-year-old who owns several vehicles and needs coverage for two teenage drivers.

Enhance digital self-service tools

Providers can also improve the insurance customer experience by offering digital self-service tools. Today’s consumers are looking for convenience, even with their insurance coverage, and the traditional methods of visiting an office or waiting to speak with a representative over the phone are no longer considered acceptable.

To meet evolving customer expectations, insurers may consider investing in user-friendly online portals or mobile apps where policyholders can manage their policies, make payments, view documents, and track claims anywhere and anytime.

Provide proactive communication

Another way to improve the insurance customer journey is to be proactive with communications to policyholders and keep them feeling informed. This applies to all stages of the insurance customer journey map, including during the claims process or when it’s time to renew. Insurers can leverage user-friendly channels for proactive communication, including SMS, email, or mobile notifications, which can help increase engagement and satisfaction.

Streamline policy renewal procedures

Streamlining the policy renewal process can also provide important benefits and reduce friction in the customer journey. For instance, insurers can implement automatic renewal applications, making it easier for policyholders to renew their policies with just a few clicks.

Invest in customer education programs

Lastly, insurers should invest in educational resources, which can give policyholders a better understanding of their coverage and how the claims process works. This might include offering more blog posts, webinars, or other online tools to provide guidance and recommendations at every stage of the insurance customer journey. The easier it is for policyholders to find solutions or answers to their questions, the more satisfied they will feel with their insurer.

How You Can Optimize Your Insurance Customer Journey

On each step of the insurance customer journey, insurers can enhance their policyholders’ experiences with better personalization, convenience, and transparency.

The ideal policyholder journey has changed a great deal over the last decade, and it’s now more important than ever for insurers to adapt their practices to meet the needs and expectations of modern consumers. One of the most effective ways to do this is to partner with a trusted insurance BPO provider like Covenir.

Our team of talented industry experts provide insurers with the people power they need to deliver a top-tier customer experience. Whether you need extra hands on deck with customer support, product sales, or any other stage of the policyholder journey, we have you covered. We always offer your policyholders the on-brand, quality experience they expect, helping you bring your operations to the next level of excellence.