Insurance BPO Solutions

Vision, Meet Execution

Streamline your insurance operations with Covenir’s onshore Insurance BPO Solutions, offering efficient, proactive, and on brand personalized services. Focus on growth and innovation while we handle execution and customer engagement.

We’re Not an Extension of Your Team, We ARE Your Team.

Outsourced Frontline Services

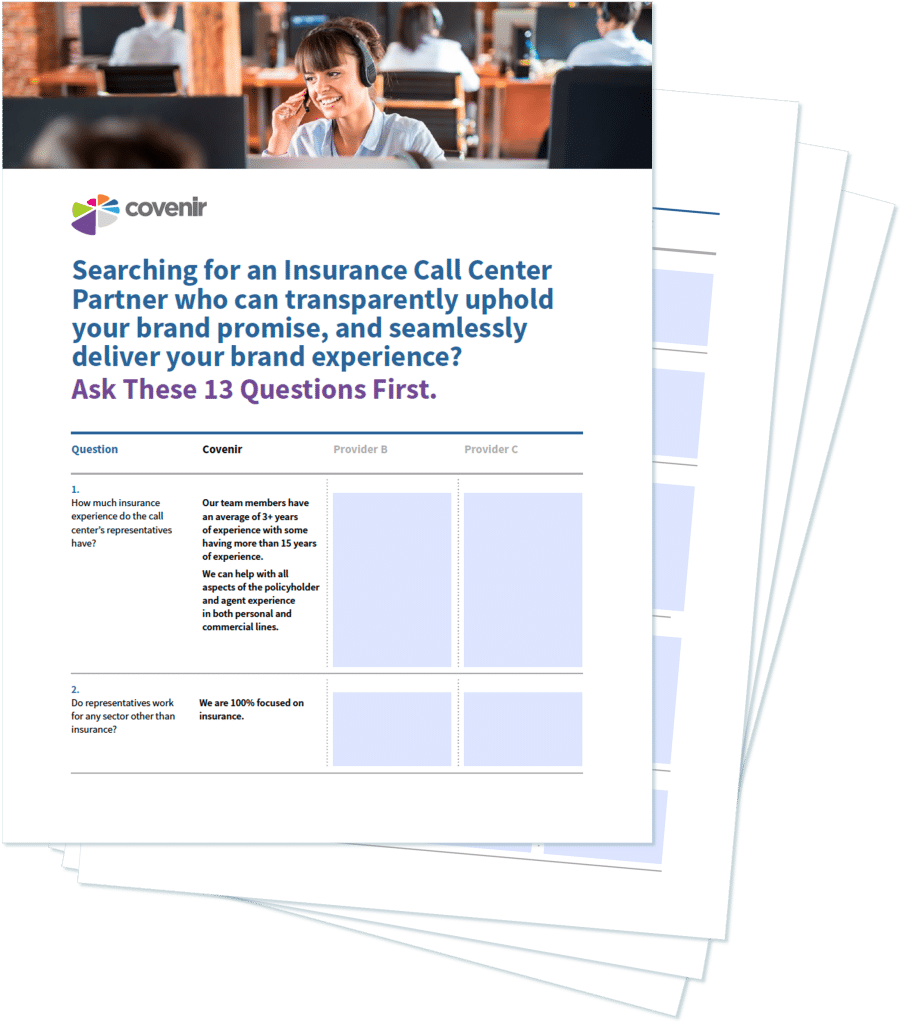

Fully trained and experienced insurance call center and customer service support team and production advisors.

Outsourced Back Office Support

Premium Services including inbound premium payments to outbound agency commission checks and underwriting support and services

Outsourced Print Distribution

Full-service print and distribution with a virtual mail room to modernize communication processes.

Not sure of your needs?

We know the insurance industry inside-out and create custom solutions for every business function. Imagine the experience, we can deliver.

Explore Our Insurance Outsourcing Case Studies

Scale Rapidly in a Dog-Eat-Dog World

Case in Point Scale Rapidly in a Dog-Eat-Dog WorldThe Need FIGO makes pet insurance simple for pet...

Focus on Growth… Without Operational and Staffing Challenges

Focus on Growth… Without Operational and Staffing ChallengesThe Company Headquartered in...

Delight Policyholders & Agents With an FNOL “Easy” Button

Delight Policyholders & Agents With an FNOL "Easy" ButtonThe Company Headquartered in Tampa,...

Follow Our Thought Leadership

First Notice of Loss (FNOL): How It Works, Outsourcing Options, and More

Insurers looking to boost operational efficiency and identify areas for cost savings often turn to...

Understanding the Insurance Customer Journey to Drive Business Growth

From the time a consumer realizes they need new insurance coverage to when they renew their...

The Future of Direct-to-Consumer Insurance Sales

Insurers have been transitioning from traditional distribution channels to online platforms over...